The “Company” You Keep:

Form ATS-N Reveals How Brokers’ Desks and Affiliates Interact in Their Dark Pools

By Craig Viani, Head of US Market Structure

December 2, 2019 | Updated December 9, 2019

Estimated read time: 16 minutes

This paper is part two in a series of three on new dark pool regulations, focusing specifically on the answers provided by NMS Stock ATSs to the questions posed in Part II of Form ATS-N. For the first paper in our series which reviewed the 20-year history of dark pool rules to detect patterns and trends, read the full piece here.

Two decades after the SEC’s initial dark pool regulation, the US regulator is addressing concerns that the relationship between broker dealers (BDs) and the ATSs they operate is not only more complex and intertwined, but potentially open to conflicts of interest.1 To address this, the SEC now requires all NMS Stock ATSs to provide more detail on how their dark pools operate via a public “Form ATS-N."2

As of mid-October, 31 NMS Stock ATSs have filed a Form ATS-N covering:

- the ATS owner and basic details about the pool and the corresponding broker who runs it;

- ATS-related activities of the broker-dealer operator along with its affiliates including access and confidentiality; and

- a detailed description of the manner in which these ATSs operate.

This regulatory development places an obligation on institutional investors to evaluate these filings and formulate policies and procedures to help drive their best execution practices. The filings are living documents and over time they will be amended as a pool increases in complexity and material changes occur. To assist the buy side, we have summarized answers from all registered NMS Stock ATSs to uncover key trends on broker-dealer access and confidentiality.3

When viewed in aggregate, Form ATS-N filings provide a clearer picture of the common practices across dark pool providers. Examined individually, actions of a pool operator can be scrutinized relative to its peers. Combining both approaches, the new disclosures provide an introduction into the subtleties and complexities that each dark pool practices. The question for asset managers is what level of scrutiny should be applied to these filings and how does this align with the firm’s execution principles?

All in the Family: Trading Activities in the ATS

Items 1 and 2 in Part II of Form ATS-N question whether any business units or affiliates of a broker operator can direct orders into their ATS. If so, it asks if such business units or affiliates have different access than other subscribers.What this means for users:

The SEC recognizes that many NMS Stock ATSs are operated by multi-service broker-dealers, whose internal business activities with associated firms have become increasingly interwoven with those of the dark pool, adding complexity to their operations4 and potential confusion for buy-side traders who access these pools. While it should not be a surprise that affiliates can access broker dark pools, these new disclosures should encourage institutional investors to review the differentiated service models for potential conflicts of interest that could undermine quality of execution.

What the data tells us: 5

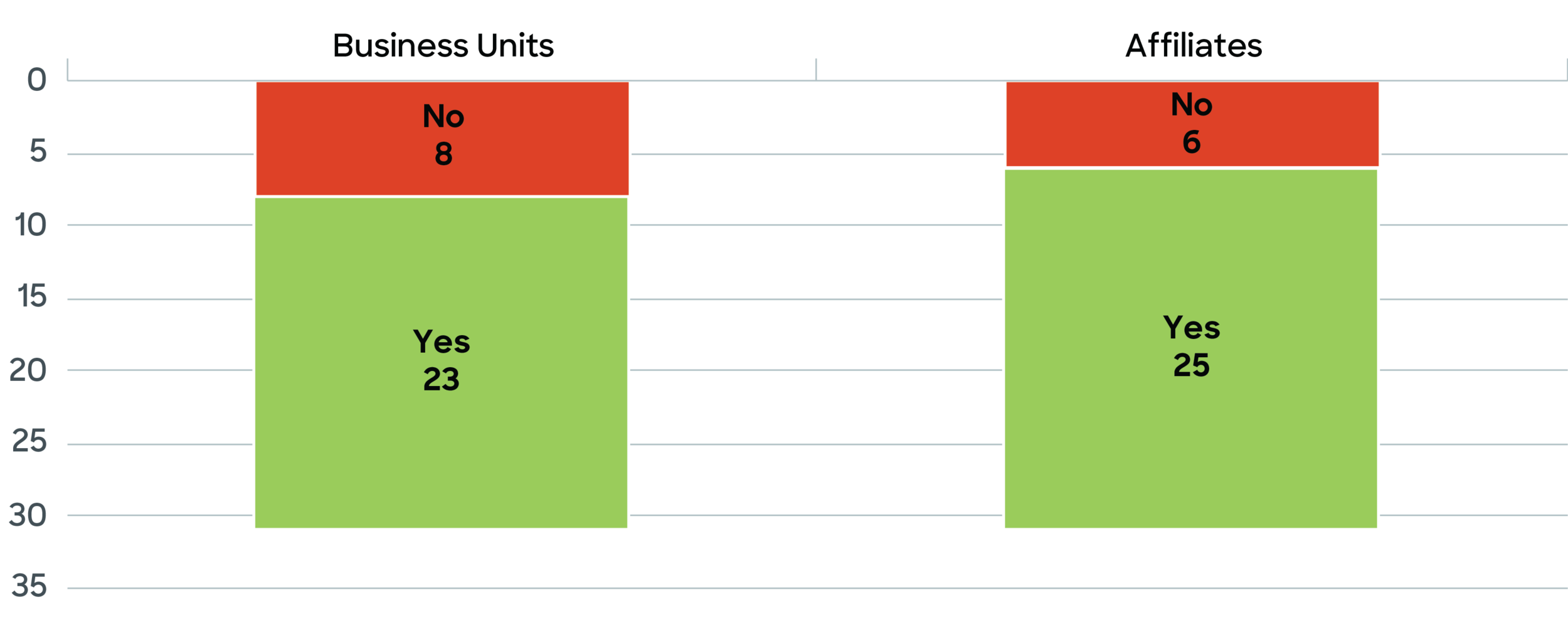

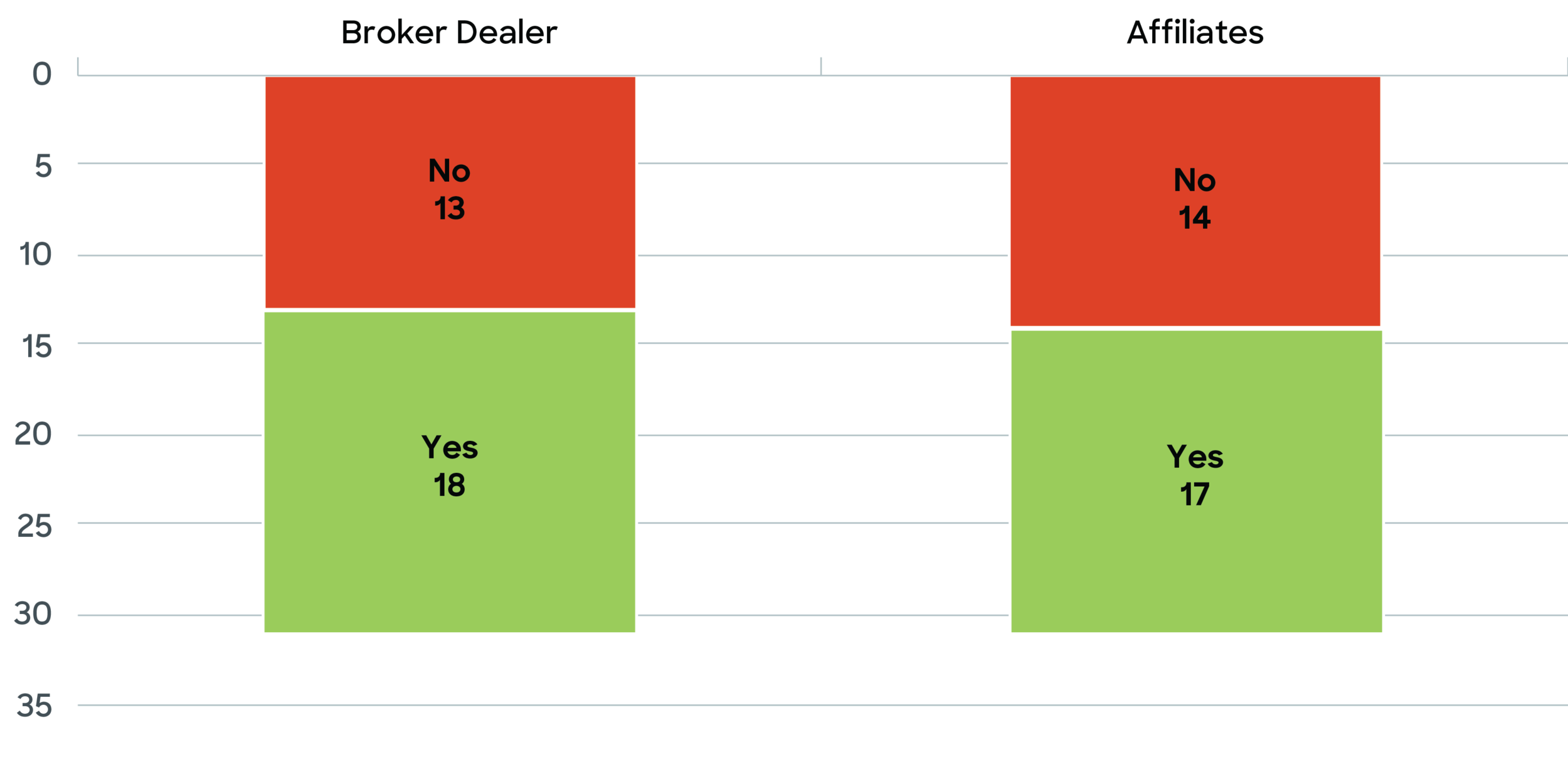

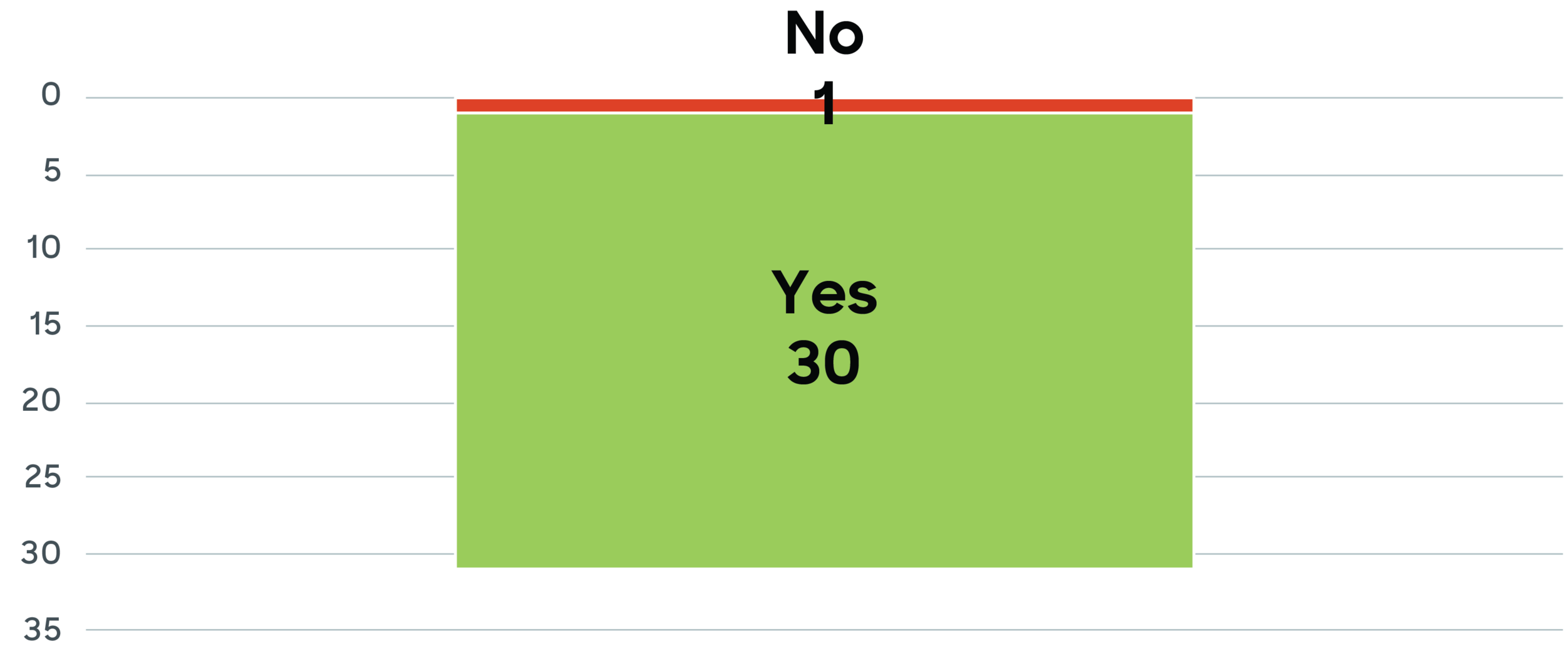

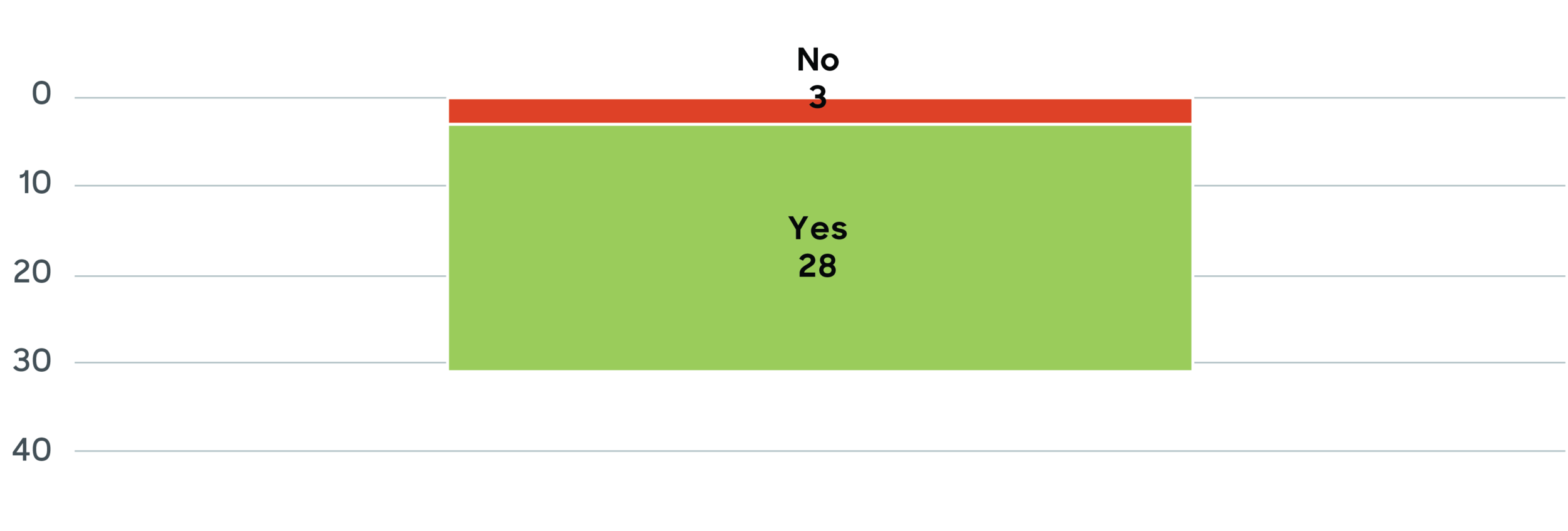

Based on the aggregated filing data, 23 of the 31 pools allow business units to enter or direct orders to their pool. In these filings, brokers identify many of the business units as varieties of trading desks. Whereas smaller, agency-oriented firms often reference electronic/algo desks, the bulge brokers list a much wider range including cash, derivatives, ETF, market making, PT, and delta one desks as well as central risk books. Across both, only four pools do not permit either business unit or affiliate trading activity (BIDS, CODA, DEALERWEB, and IntelligentCross).

Are Business Units or Affiliates permitted to enter or direct orders into the NMS Stock ATS?

If yes...

Next up...

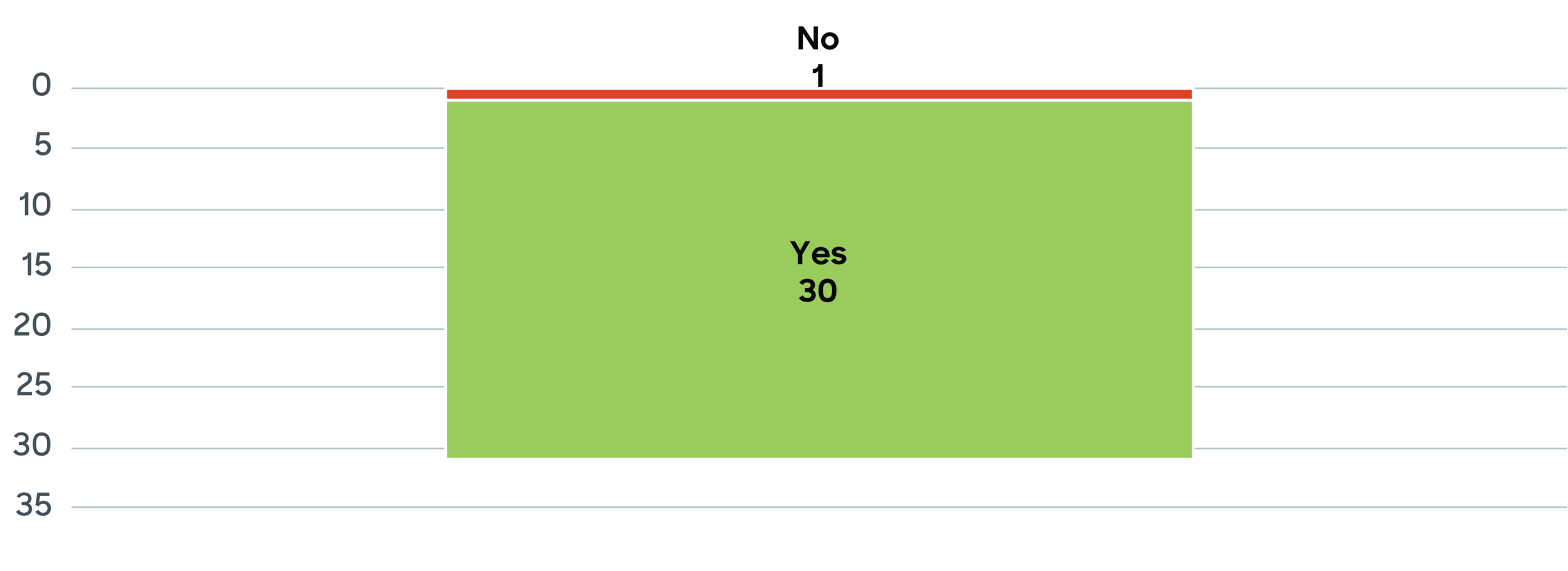

Similar to business units, 25 of the 31 NMS Stock ATSs allow affiliate access. In the filings, affiliates vary from singular relationships for stand-alone pools (e.g. Cantor’s association to AQUA, FMR to Luminex) to bulge-bracket brokers with an extensive number of domestic and international affiliations (Morgan Stanley who runs three ATSs has over 700 affiliates according to the filings).

Of the 25 pools that allow for affiliate access, one-third provide different services relative to subscribers. Like business units, some brokers block direct access to affiliates, limiting interaction via an SOR or algos. A few do, however, offer direct access. Others provide permissioning, limiting interactions and opting out on a level that was greater than or different to traditional subscribers.

Of all the pools with business units or affiliates, only Ustocktrade has a formal arrangement providing orders to their pool. They also are the only venue that allowed orders to be routed to a trading center controlled by the BD. Ustocktrade (USTK) is a retail platform that allows peer-to-peer matching with T+0 settlement. Since peer counterparties are often not available, market makers (known as “Super Users”) through the USTK proprietary trading desk respond to liquidity requests including symbol and side. The trading desk has the right, but not the obligation, to fill customer orders.6

You’re Out: Controlling Order Interactions with BDs and Affiliates

Item 3 requires NMS Stock ATSs to indicate whether subscribers can opt out of interacting with the broker operator’s flow and/or its affiliates.What this means for users:

The SEC’s intention is to provide clarity around the terms in which subscribers can choose not to interact with certain trading desks or partners; as an institutional trader, understanding these variances is helpful.

Just as important, though, would be to understand why certain operators choose to disallow opting out. If opt outs are disallowed, institutions may want to challenge those brokers on the quality of execution these desks or partners provide or, at a minimum, require segmented TCA to show performance of those pool participants who you have no choice but to interact with.

What the data tells us: 7

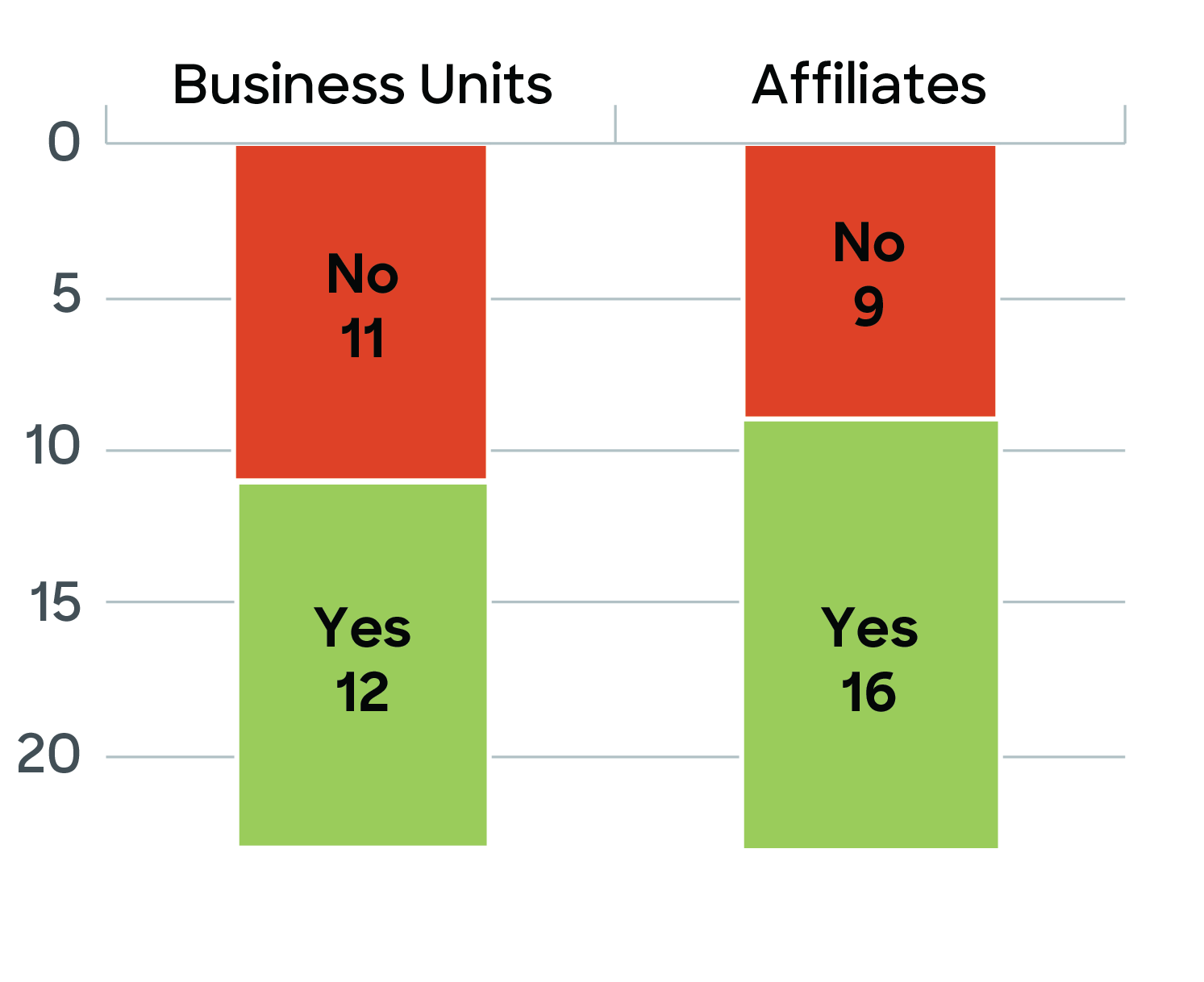

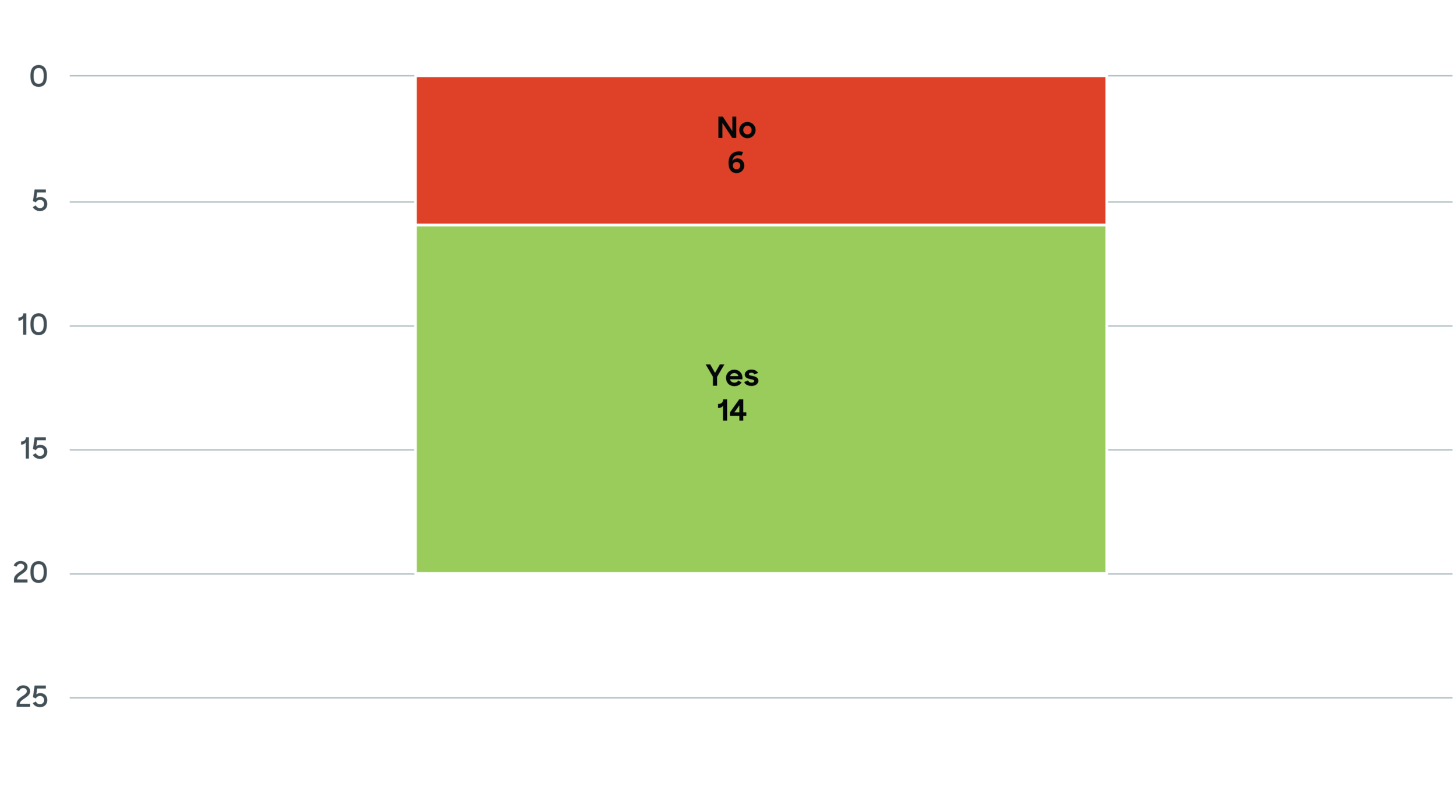

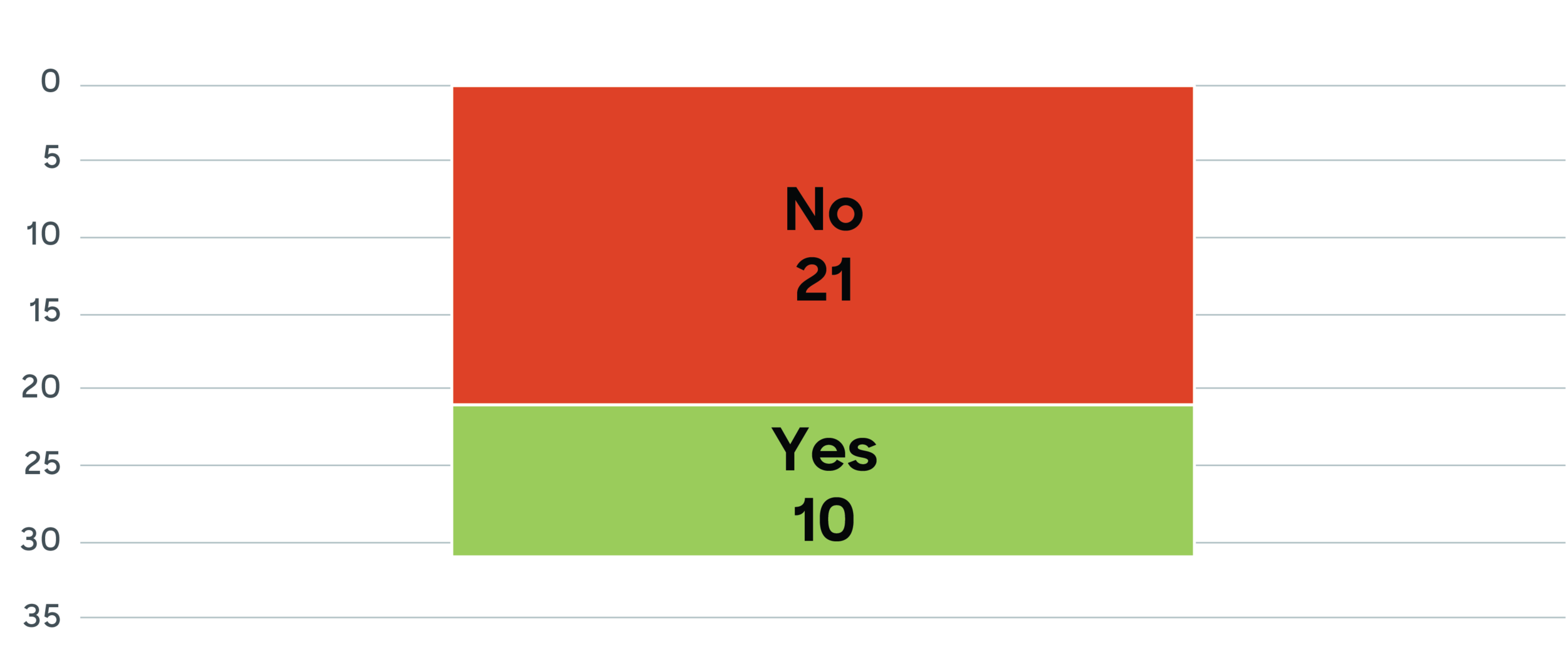

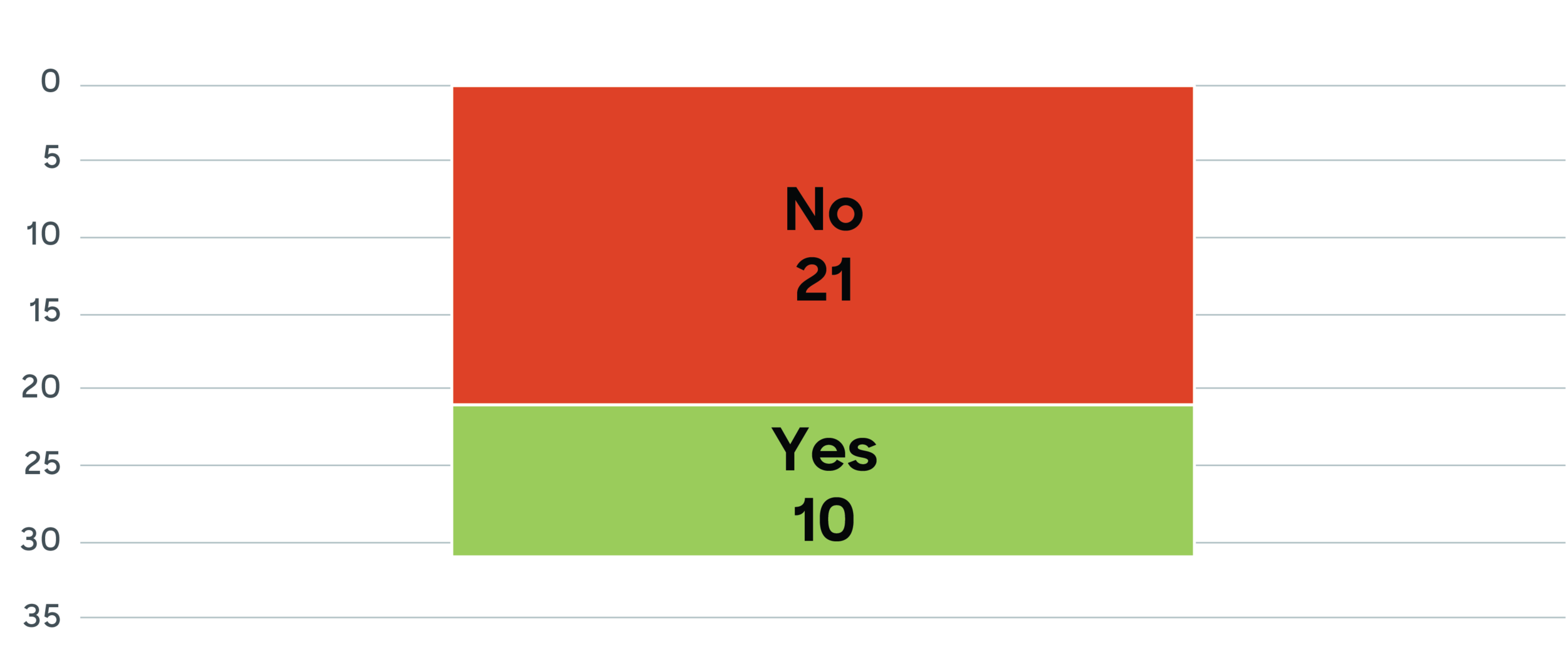

Eighteen pools permit opt outs with the broker dealer operator itself while 17 allow restrictions on trading with an affiliate (with a few pools consenting to opts out for one and not the other – see Appendix 3).

Principal flow is the most common dark pool liquidity that subscribers are permitted to opt out from. Other common opt outs are by order type (e.g. conditional orders) and counter-party permissioning and segmentation. Affiliate opt outs follow similar choices, especially when an operator offers both BD and affiliate access. Of the six pools whose opt out procedures differ for subscribers, half of them cite the difference being related to opt outs for institutional participants only.

Can any Subscriber opt out from interacting with orders and trading interest of the Broker-Dealer or its affiliate?

If yes...

Arranged Marriages: BD’s Relationships with Other Trading Centers

Given that there is greater focus on delivering best execution, several brokers operating ATSs have arrangements with other trading center operators to improve liquidity aggregation. Item 4 in Part II of Form ATS requires ATSs to disclose these relationships to users of the dark pool.What this means for users:

This enables the buy side to potentially uncover any possible questionable bilateral agreements between different brokers. However, while this sheds light on the inbound relationships to dark pools, it doesn’t provide an accurate depiction of how their order is handled outbound by their broker.

In today’s electronic marketplace, it’s highly likely institutions are leveraging one of these brokers to access some or all of the rest of the pools. As a result, although Form ATS-N provides new pieces of information about broker-to-venue interaction, traders and compliance will need to dig deeper to understand a broker’s precise order handling practices.

What the data tells us: 8

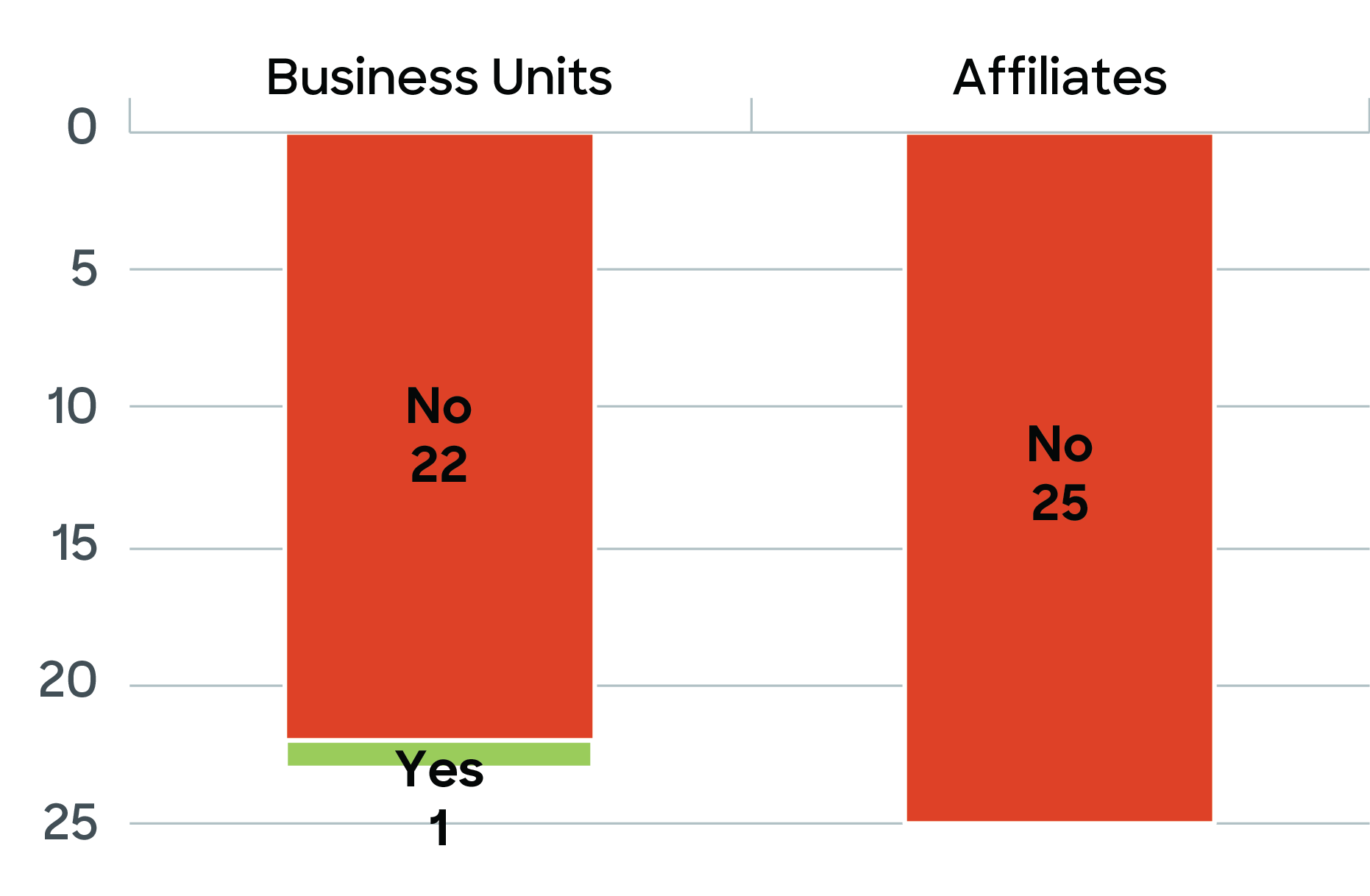

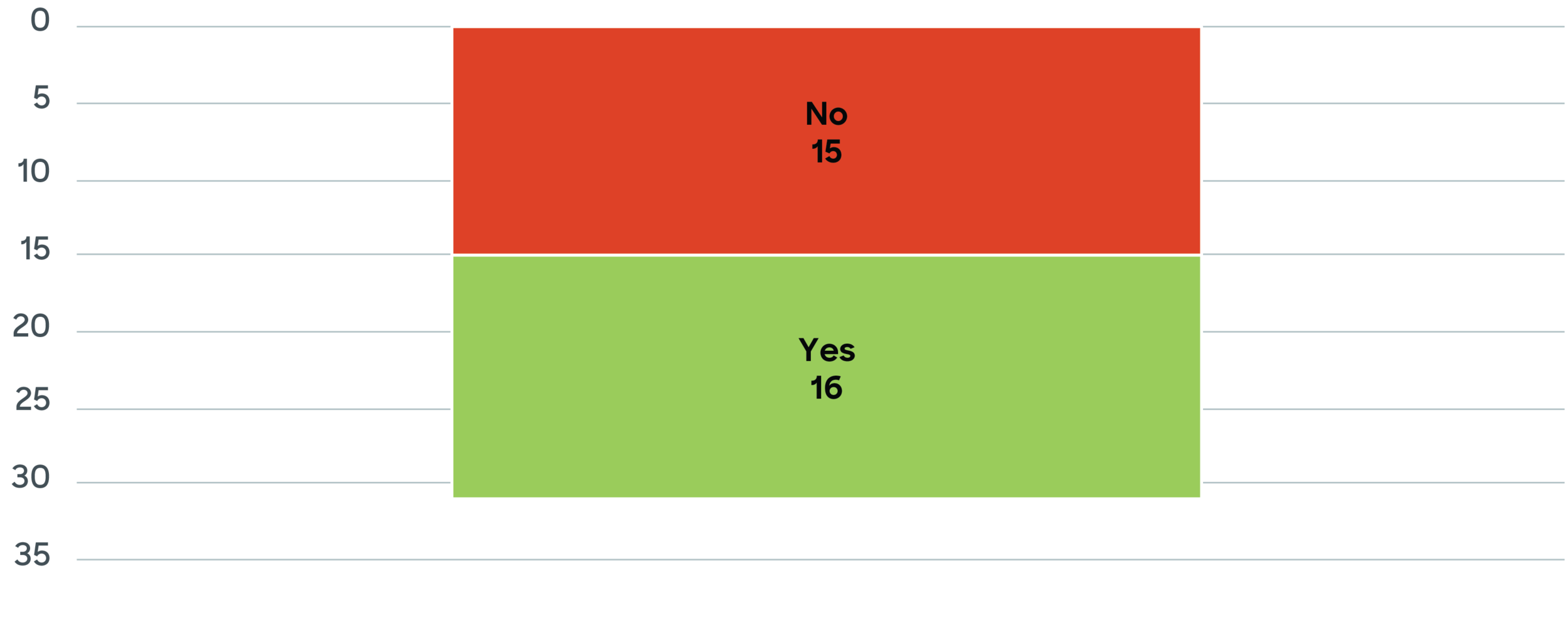

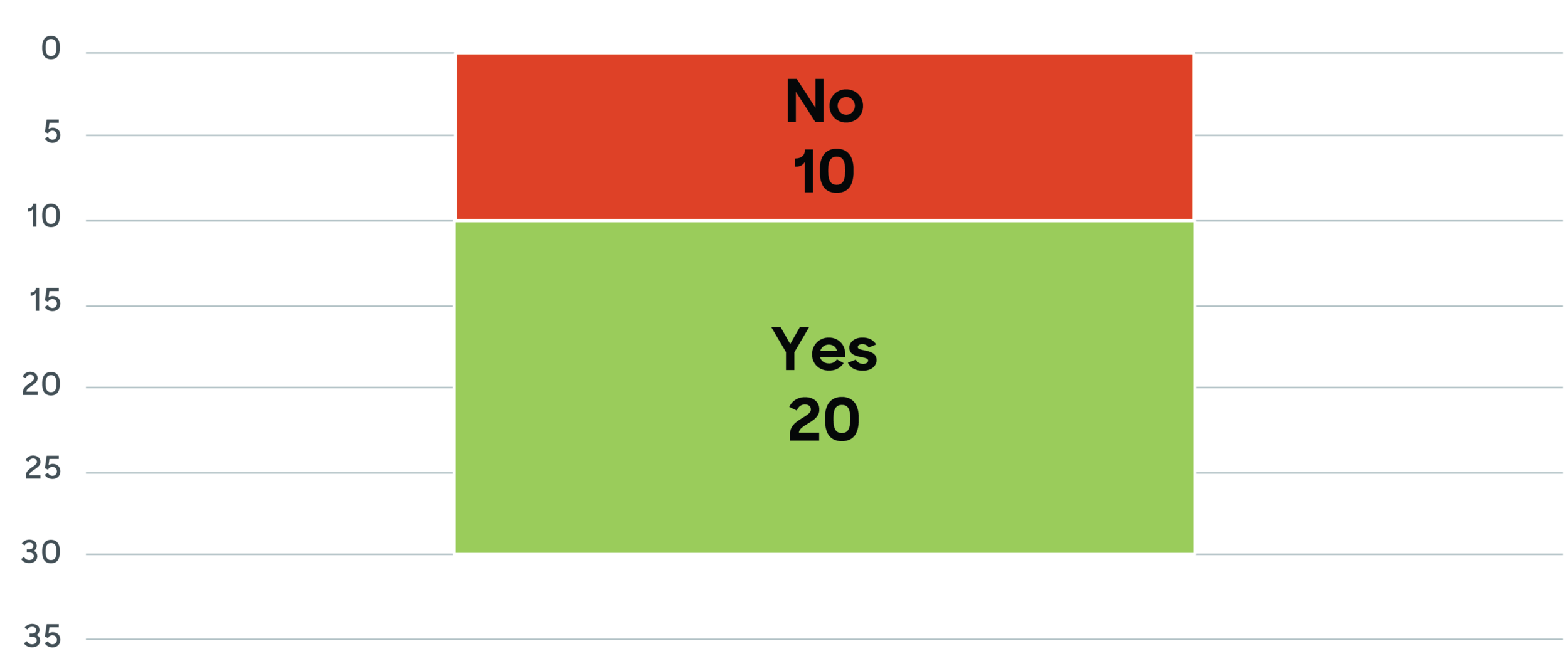

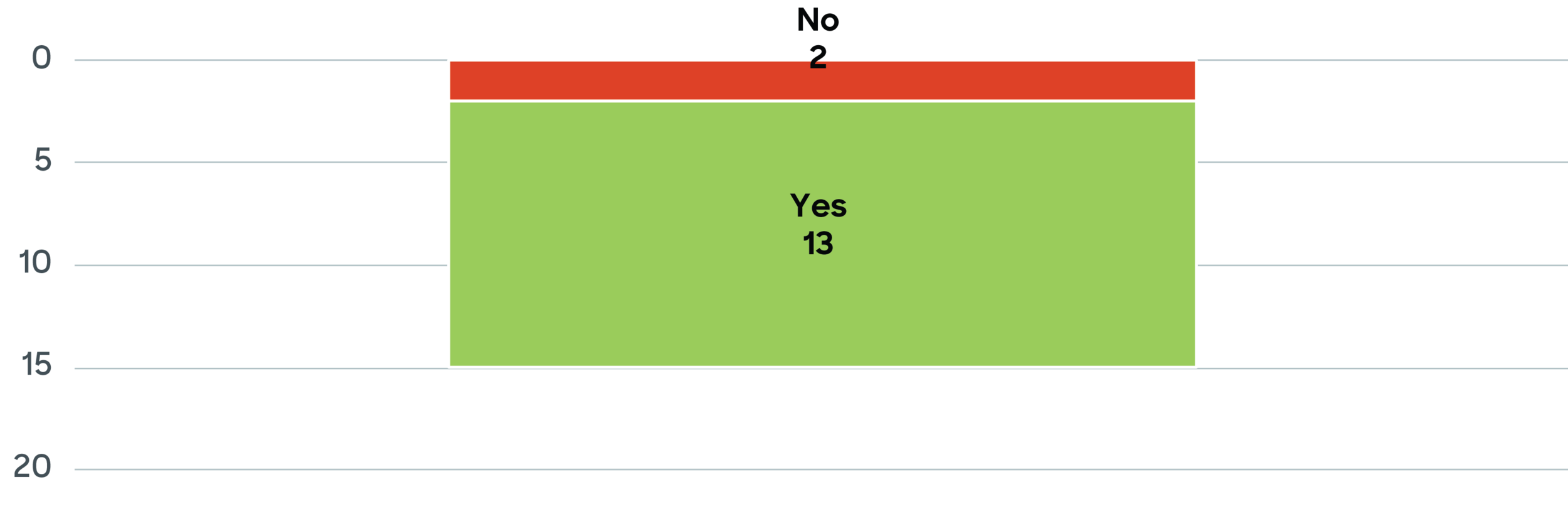

Sixteen broker operators have either informal or formal arrangements with other NMS Stock ATSs. The majority of BDs who affirmed such arrangements use terms like “mutual access,” “bilateral,” “written,” and “electronic access” to describe these agreements.

The main exception is CODA, who disclose a payment for order flow arrangement with ACS Execution Services in the form of a profit-sharing agreement where some trades are executed on a net basis. There is no preferential routing arrangement and no obligation to send any orders to each other.

Are there any arrangements between the Broker-Dealer Operator and a Trading Center to access the NMS Stock ATS services?

If yes...

Diving in with Both Feet: Other Ways to Access Pools

In Item 5, the SEC asks if a broker operator or affiliate offers additional products and services that access its pools beyond standard matching in its ATS.What this means for users:

By understanding what other services have access to the dark pool, investors may have the opportunity to reverse engineer some of the mechanisms, strategies, and practices that each broker operator leverages to drive flow through their pool. By better understanding these internal ecosystems, institutional firms are more empowered to formulate a strategy that provides them the most beneficial access to each pool.

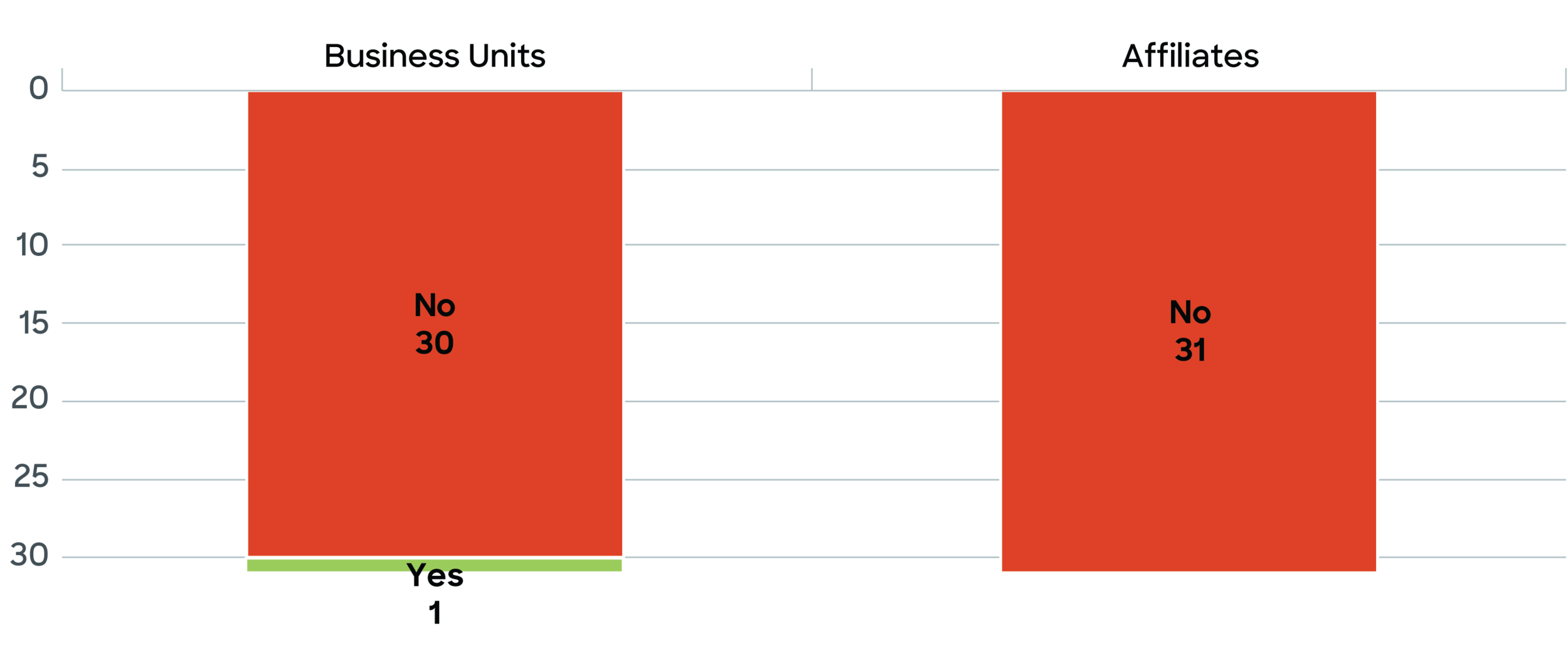

What the data tells us: 9

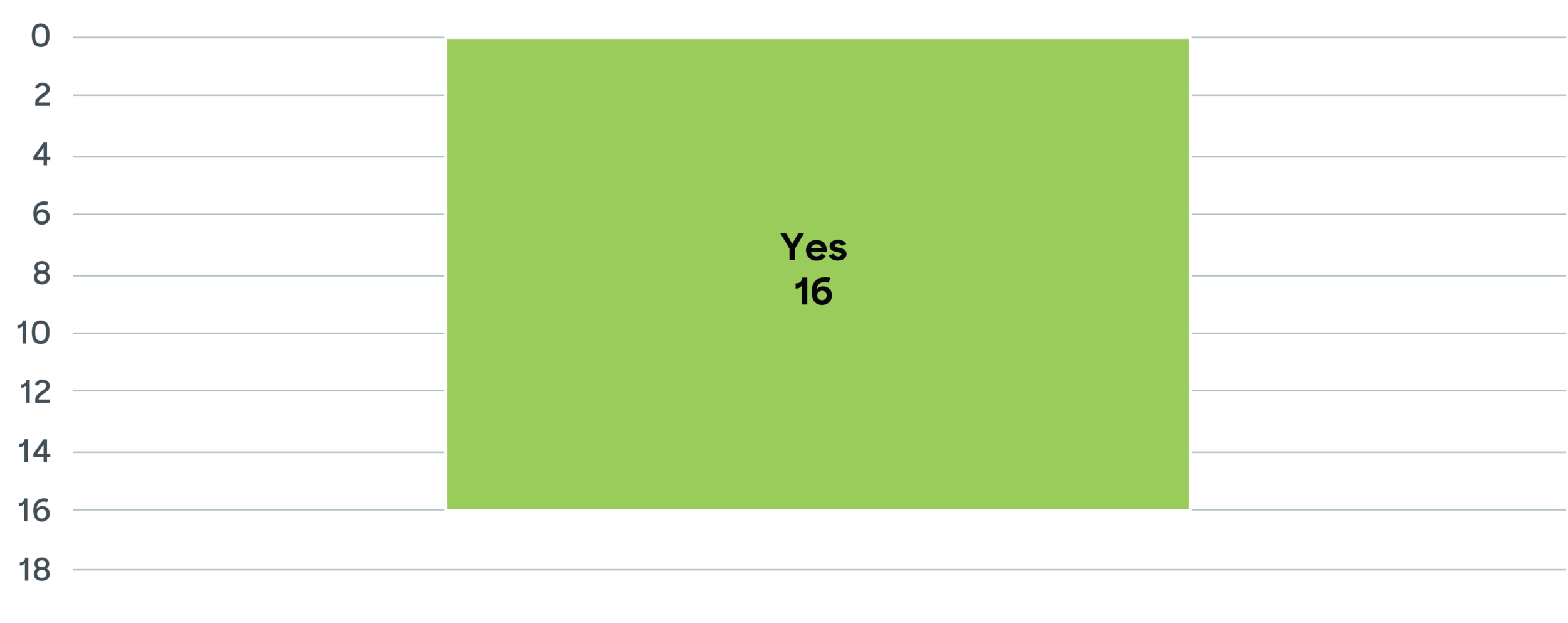

All pools except for LeveL verify that they offer a variety of ways to submit orders or effect transactions. In terms of products, algorithms and SORs are often cited. Systems such as EMSs, OMSs, front ends (“GUIs”), and apps are common entry points as well.

Two-thirds of the firms offering products and services into their pools affirm that their terms and conditions may be different based on subscribers. Given that many pools allow a variety of participants including brokers and institutional investors, a number of pools classify their subscribers and calibrate the products based on those groupings.

A third of broker operators’ affiliates also offer products and services that access their pools. Many were system solutions which allowed these firms to direct orders to the venue.

If yes...

If yes...

Keeping Others in the “Dark”: Confidentiality of Subscriber Information

Items 6 of Form ATS-N focuses on dark pool support and which personnel at each broker has access to a subscriber’s trading information. In almost all cases, employees who service NMS Stock ATSs also have other business responsibilities. This shouldn’t be a surprise given that trading technologies within a broker are frequently centralized and resources often shared across business units.What this means for users:

Confidentiality has always been a double-edged sword for dark pools. Participants in a pool are highly sensitive about anonymity, especially when their parent orders are large in size or percentage of ADV and any unnecessary information leakage could impact execution performance. With the proliferation of conditional orders, these large positions are exposed to multiple venues simultaneously, and this sensitivity can be exacerbated. On the other hand, investors cannot expect brokers to run a pool in total isolation. Ringfencing technology can be cost prohibitive and purposefully choosing to not leverage a firm’s overlapping resources can be seen as inefficient. Buy-side firms have to temper their expectations of information exclusivity and instead challenge brokers to provide justifications for the various disclosures listed in their Form ATS-N filings.

Does any "shared employee" of the BD or Affiliate that services both the ATS and any other business unit or Affiliate have access to confidential trading information on the ATS?

Does any entity, other than the BD, support the services or functionalities of the NMS Stock ATS (“service provider”)?

If yes...

And for those that answer “Yes” to that…

What the data tells us: 10

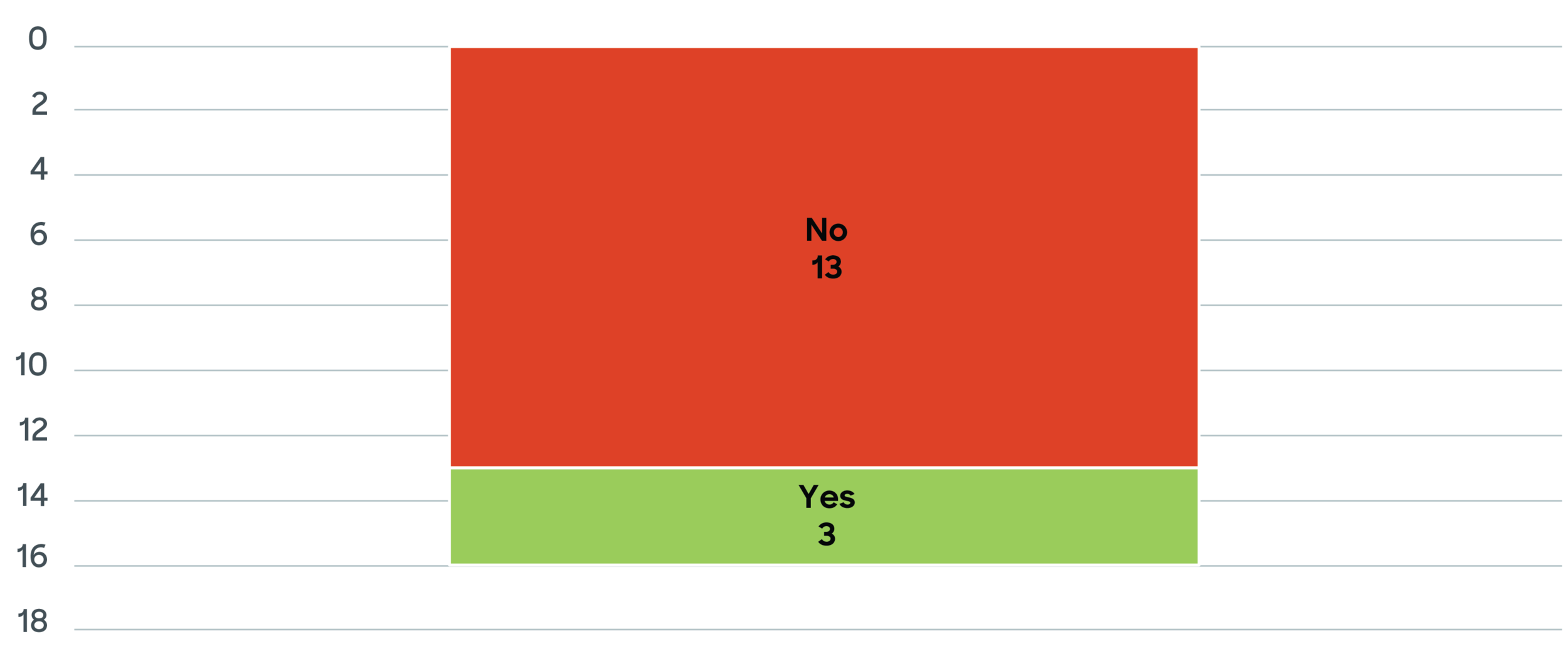

All pools except three (the stand-alone venues BIDS, LeveL, and Luminex) leverage “shared employees“ in their support structure. Similarly, all but one pool (DEALERWEB) affirm that they leverage third party service providers for some or all of the components of their ATSs. This list includes but is not exclusive to clearing, market data feeds, data centers, fix engines, technology platforms, matching engines, and connectivity. Half of these pools leveraging service providers also allow those service providers access into the pool. In this case, these providers are usually either affiliates of the firms or owned by firms who are also subscribers to their pool.

Item 7, the final section of Part II of Form ATS-N, requires ATSs to describe their written safeguards and procedures to protect subscriber’s confidential trading information and their ability to control who sees this info beyond ATS employees. Half of the NMS Stock ATSs allow subscribers to share their confidential trading information with others beyond employees of the ATS and also allow subscribers to withdraw such consent.

Can a Subscriber consent to the disclosure of its confidential trading information to any Person beyond employees of the ATS?

If yes...

“Dirty Pool”s

The phrase “dirty pool” originated in the early 20th century to describe underhanded, dishonest, and devious actions likely linked to unscrupulous gambling tactics.11 In US equities earlier this decade, the saying could have easily been coopted to describe the gray manner in which some ATS conducted business. According to The Wall Street Journal , brokers have been fined by the SEC and other regulators over $229 million since 2011 for wrongdoing that involved dark pools.12In response, the SEC overhauled their two-decade-old ATS-Ns registration requirements to deliver investors greater transparency into these dark pool practices. In contrast to Form ATS from 1998, Form ATS-N requires broker operators to provide extensive detail into the operations of their ATS. Also, unlike the original Form ATS filings which became effective without detailed SEC evaluation or required public disclosure, Form ATS-Ns have been subject to extensive SEC review and are available for public examination.13

Enter the “Matrix”

For those of you wishing to “take the red pill” and dive deeper into the 31 Form ATS-N filings yourself, or at minimum establish baseline knowledge which may influence your evaluation process going forward, we have provided a matrix for all ATS operators’ yes/no answers in Part II of Form ATS-N.Click here to view each Item in Part II in a simple table format.

In our next ATS-N paper, we will take you down that rabbit hole and explore the daily manner of operations in dark pools from connectivity to order entry to order types to trade reporting.

1 "We are also concerned that the lack of available information about the ATS-related activities of the broker-dealer operator and its affiliates may hinder the ability of market participants to evaluate potential conflicts of interest.” Regulation of NMS Stock Alternative Trading Systems, pg 14. https://www.sec.gov/rules/final/2018/34-83663.pdf

2 SEC Adopts Rules to Enhance Transparency and Oversight of Alternative Trading Systems, https://www.sec.gov/news/press-release/2018-136

3 Each exhibit in this paper gives a visual representation of the aggregated yes/no answers for all seven items in Part II of the 31 Form ATS-N filings. In some cases, arrows will indicate follow-up questions. For simplicity, questions shown in the exhibits have been shortened from their original format in the ATS filings. To view any question in its entirety, please refer to the appendices.

4 “Many NMS Stock ATSs are operated by multi-service broker-dealers, whose business activities have become increasingly intertwined with those of the ATS, adding further complexity to their operations of NMS Stock ATSs and creating the potential for conflicts between the interests of the broker-dealer operator and the ATS’s subscriber.” Regulation of NMS Stock Alternative Trading Systems, pg 14. https://www.sec.gov/rules/final/2018/34-83663.pdf

5 Analysis of data from Part II, Items 1 and 2 of the 31 Form ATS-N filings as of November 7th for accessible download here: https://www.sec.gov/divisions/marketreg/form-ats-n-filings.htm

6 “Ustocktrade matches buy and sell orders between members within the network. In the event there is no member to take the other side of the order, a liquidity provider (a “Superuser”) may step in to complete the trade. The superuser is similar to a market maker, but unlike market makers the superuser does not create the market or set the price. Instead, it simply acts as the counterparty to complete the trade at the NBBO price. Ustocktrade Securities is currently the only broker dealer acting as Superuser on the Trading System.” https://www.ustocktrade.com/features/

7 Analysis of data from Part II, Item 3 of the 31 Form ATS-N filings as of November 7th for accessible download here: https://www.sec.gov/divisions/marketreg/form-ats-n-filings.htm

8 Analysis of data from Part II, Item 4 of the 31 Form ATS-N filings as of November 7th for accessible download here: https://www.sec.gov/divisions/marketreg/form-ats-n-filings.htm

9 Analysis of data from Part II, Item 5 of the 31 Form ATS-N filings as of November 7th for accessible download here: https://www.sec.gov/divisions/marketreg/form-ats-n-filings.htm

10 Analysis of data from Part II, Items 6 and 7 of the 31 Form ATS-N filings as of November 7th for accessible download here: https://www.sec.gov/divisions/marketreg/form-ats-n-filings.htm

11 “’Dirty pool’ refers to underhanded or unsportsmanlike conduct and that term has been traced back to 1918. Although the allusion to the game of billiards isn't evident in the quote, the game is the source of dirty pool. Pool takes its name from the French word poule, which originally referred to the stakes bet in a card game and then extended in meaning to the card game itself and the cue-and-ball game of billiards...” https://www.merriam-webster.com/words-at-play/1918-word-list/dirty-pool

12 Wall Street's Dark Pools Get Transparency Makeover, WSJ https://www.wsj.com/articles/wall-streets-dark-pools-face-new-transparency-rules-1531924509 “Banks and brokers have paid more than $229 million in fines to the SEC and other regulators since 2011 for wrongdoing that involved dark pools...”

13 There are 536 references to “effectiveness” in the Federal Register version of Regulation of NMS Stock Alternative Trading Systems, https://www.sec.gov/rules/final/2018/34-83663.pdf In particular, Section IV. “Form ATS-N Filing Process; Effectiveness Review” provides the most comprehensive description of the filing process.

Appendix:

Below are matrices representing the yes/no answers for all question from Items 1-7 in Part II of Form ATS-N for each NMS Stock ATS. Answers in green indicate follow up questions that required written responses. Questions not requiring responses are indicated in gray.All of the individual NMS Stock ATSs Form ATS-N filings can be accessed at https://www.sec.gov/divisions/marketreg/form-ats-n-filings.htm

Item 1: Broker-Dealer Operator Trading Activities in the ATS

1a) Are business units of the Broker-Dealer Operator permitted to enter or direct the entry of orders and trading interest (e.g., quotes, conditional orders, or indications of interest) into the NMS Stock ATS?

1b) If yes to Item 1a) , are the services that the NMS Stock ATS offers and provides to the business units required to be identified in Item 1a) the same for all Subscribers?

1c) Are there any formal or informal arrangements with any of the business units required to be identified in Item 1a) to provide orders or trading interests to the NMS Stock ATS (e.g., undertaking to buy or sell continously, or to meet specified thresholds of trading or quoting activity)?

1d) Can orders and trading interest in the NMS Stock ATS be routed to a Trading Center operated or controlled by the Broker-Dealer Operator?

| ATS Name | 1a) | 1b) | 1c) | 1d) |

|---|---|---|---|---|

| Aqua | No | No | ||

| BIDS | No | No | ||

| CODA | No | No | ||

| DEALERWEB | No | No | ||

| LeveL | No | No | ||

| IntelligentCross | No | No | ||

| Luminex | No | No | ||

| PRO Securities | No | No | ||

| Instinet BlockCross | Yes | Yes | No | No |

| DB SuperX | Yes | Yes | No | No |

| Instinet CBX | Yes | Yes | No | No |

| Virtu ITG POSIT | Yes | Yes | No | No |

| JPB-X | Yes | Yes | No | No |

| JPM-X | Yes | Yes | No | No |

| MS POOL | Yes | Yes | No | No |

| MS RPOOL | Yes | Yes | No | No |

| MS Trajectory Cross | Yes | Yes | No | No |

| Piper XE | Yes | Yes | No | No |

| GSCO Sigma X2 | Yes | Yes | No | No |

| Instinet Crossing | Yes | Yes | No | No |

| CitiBLOC | Yes | No | No | No |

| CSFB Crossfinder | Yes | No | No | No |

| IBKR ATS | Yes | No | No | No |

| Virtu MatchIt | Yes | No | No | No |

| The Barclays ATS | Yes | No | No | No |

| Liquidnet H2O ATS | Yes | No | No | No |

| Liquidnet Negotiation ATS | Yes | No | No | No |

| BofA Instinct X | Yes | No | No | No |

| UBS ATS | Yes | No | No | No |

| Fidelity CrossStream | Yes | No | No | No |

| Ustocktrade | Yes | No | Yes | Yes |

Item 2: Affiliates Trading Activities on the ATS

2a) Are Affiliates of the Broker-Dealer Operator permitted to enter or direct the entry of orders and trading interest into the NMS Stock ATS?

2b) If yes, to Item 2a) , are the services that the NMS Stock ATS offers and provides to the Affiliates required to be identified in Item 2a) the same for all Subscribers?

2c) Are there any formal or informal arrangements with an Affiliate required to be identified in Item 2a) to provide orders or trading interest to the NMS Stock ATS (e.g., undertaking to buy or sell continuously, or to meet specified thresholds of trading or quoting activity)?

2d) Can orders and trading interest in the NMS Stock ATS be routed to a Trading Center operated or controlled by an Affiliate of the Broker-Dealer Operator?

| ATS Name | 2a) | 2b) | 2c) | 2d) |

|---|---|---|---|---|

| BIDS | No | No | ||

| CODA | No | No | ||

| DEALERWEB | No | No | ||

| IntelligentCross | No | No | ||

| Piper XE | No | No | ||

| Ustocktrade | No | No | ||

| Aqua | Yes | Yes | No | No |

| Instinet BlockCross | Yes | Yes | No | No |

| CSFB Crossfinder | Yes | Yes | No | No |

| DB SuperX | Yes | Yes | No | No |

| LeveL | Yes | Yes | No | No |

| Instinet CBX | Yes | Yes | No | No |

| JPB-X | Yes | Yes | No | No |

| JPM-X | Yes | Yes | No | No |

| Luminex | Yes | Yes | No | No |

| BofA Instinct X | Yes | Yes | No | No |

| MS POOL | Yes | Yes | No | No |

| MS RPOOL | Yes | Yes | No | No |

| MS Trajectory Cross | Yes | Yes | No | No |

| PRO Securities | Yes | Yes | No | No |

| GSCO Sigma X2 | Yes | Yes | No | No |

| Instinet Crossing | Yes | Yes | No | No |

| CitiBLOC | Yes | No | No | No |

| IBKR ATS | Yes | No | No | No |

| Virtu ITG POSIT | Yes | No | No | No |

| Virtu MatchIt | Yes | No | No | No |

| The Barclays ATS | Yes | No | No | No |

| Liquidnet H2O ATS | Yes | No | No | No |

| Liquidnet Negotiation ATS | Yes | No | No | No |

| UBS ATS | Yes | No | No | No |

| Fidelity CrossStream | Yes | No | No | No |

Item 3: Order Interaction with Broker-Dealer Operator; Affiliates

3a) Can any Subscriber opt out from interacting with orders and trading interest of the Broker-Dealer Operator in the NMS Stock ATS?

3b) Can any Subscriber opt out from interacting with the orders and trading interest of an Affiliate of the Broker-Dealer Operator in the NMS Stock ATS?

3c) If yes to Item 3a) or 3b) , are the terms and conditions of the opt-out processes required to be identified in Item 3a) , 3b) , or both, the same for all Subscribers?

| ATS Name | 3a | 3b) | 3c) |

|---|---|---|---|

| Aqua | No | No | |

| BIDS | No | No | |

| CODA | No | No | |

| DEALERWEB | No | No | |

| Instinet CBX | No | No | |

| IntelligentCross | No | No | |

| Luminex | No | No | |

| Piper XE | No | No | |

| PRO Securities | No | No | |

| Ustocktrade | No | No | |

| Instinet Crossing | No | No | |

| LeveL | No | Yes | Yes |

| Virtu ITG POSIT | No | Yes | Yes |

| CSFB Crossfinder | Yes | No | Yes |

| GSCO Sigma X2 | Yes | No | Yes |

| Virtu MatchIt | Yes | No | No |

| CitiBLOC | Yes | Yes | Yes |

| DB SuperX | Yes | Yes | Yes |

| JPB-X | Yes | Yes | Yes |

| JPM-X | Yes | Yes | Yes |

| The Barclays ATS | Yes | Yes | Yes |

| BofA Instinct X | Yes | Yes | Yes |

| MS POOL | Yes | Yes | Yes |

| MS RPOOL | Yes | Yes | Yes |

| MS Trajectory Cross | Yes | Yes | Yes |

| UBS ATS | Yes | Yes | Yes |

| Instinet BlockCross | Yes | Yes | No |

| IBKR ATS | Yes | Yes | No |

| Liquidnet H2O ATS | Yes | Yes | No |

| Liquidnet Negotiation ATS | Yes | Yes | No |

| Fidelity CrossStream | Yes | Yes | No |

Item 4: Arrangements with Trading Centers

4a) Are there any formal or informal arrangements (e.g., mutual, reciprocal, or preferential access arrangements) between the Broker-Dealer Operator and a Trading Center to access the NMS Stock ATS services (e.g., arrangements to effect transactions or to submit, disseminate, or display orders and trading interest in the ATS)?

4b) If yes to Item 4a) , are there any formal or informal arrangements between an Affiliate of the Broker-Dealer Operator and a Trading Center to access the NMS Stock ATS services?

| ATS Name | 4a) | 4b) |

|---|---|---|

| Aqua | No | |

| BIDS | No | |

| Instinet BlockCross | No | |

| DEALERWEB | No | |

| LeveL | No | |

| IBKR ATS | No | |

| Instinet CBX | No | |

| IntelligentCross | No | |

| JPB-X | No | |

| Luminex | No | |

| MS RPOOL | No | |

| MS Trajectory Cross | No | |

| Piper XE | No | |

| PRO Securities | No | |

| Instinet Crossing | No | |

| CitiBLOC | Yes | No |

| CODA | Yes | No |

| CSFB Crossfinder | Yes | No |

| DB SuperX | Yes | No |

| JPM-X | Yes | No |

| Virtu MatchIt | Yes | No |

| The Barclays ATS | Yes | No |

| BofA Instinct X | Yes | No |

| MS POOL | Yes | No |

| GSCO Sigma X2 | Yes | No |

| UBS ATS | Yes | No |

| Ustocktrade | Yes | No |

| Fidelity CrossStream | Yes | No |

| Virtu ITG POSIT | Yes | Yes |

| Liquidnet H2O ATS | Yes | Yes |

| Liquidnet Negotiation ATS | Yes | Yes |

Item 5: Other Products and Services

5a) Does the Broker-Dealer Operator offer Subscribers any products or services for the purpose of effecting transactions or submitting, disseminating, or displaying orders and trading interest in the NMS Stock ATS (e.g., algorithmic trading products that send orders to the ATS, order management or order execution systems, data feeds regarding orders and trading interest in, or executions occurring on, the ATS)?

5b) If yes to Item 5a) , are the terms and conditions of the services or products required to be identified in Item 5a) the same for all Subscribers and the Broker-Dealer Operator?

5c) Does any Affiliate of the Broker-Dealer Operator offer Subscribers, the Broker-Dealer Operator, or both, any products or services for the purpose of effecting transactions or submitting, disseminating, or displaying orders or trading interest in the NMS Stock ATS?

5d) If yes to Item 5c) , are the terms and conditions of the services or products required to be identified in Item 5c) the same for all Subscribers and the Broker-Dealer Operator?

| ATS Name | 5a) | 5b) | 5c) | 5d) |

|---|---|---|---|---|

| LeveL | No | No | ||

| BIDS | Yes | Yes | No | |

| Instinet BlockCross | Yes | Yes | No | |

| CitiBLOC | Yes | Yes | No | |

| CSFB Crossfinder | Yes | Yes | No | |

| DB SuperX | Yes | Yes | No | |

| Instinet CBX | Yes | Yes | No | |

| IntelligentCross | Yes | Yes | No | |

| BofA Instinct X | Yes | Yes | No | |

| MS POOL | Yes | Yes | No | |

| MS RPOOL | Yes | Yes | No | |

| MS Trajectory Cross | Yes | Yes | No | |

| Piper XE | Yes | Yes | No | |

| PRO Securities | Yes | Yes | No | |

| Instinet Crossing | Yes | Yes | No | |

| DEALERWEB | Yes | Yes | No | |

| CODA | Yes | Yes | Yes | Yes |

| JPB-X | Yes | Yes | Yes | Yes |

| JPM-X | Yes | Yes | Yes | Yes |

| GSCO Sigma X2 | Yes | Yes | Yes | Yes |

| Luminex | Yes | Yes | Yes | No |

| Aqua | Yes | No | No | |

| IBKR ATS | Yes | No | No | |

| The Barclays ATS | Yes | No | No | |

| UBS ATS | Yes | No | No | |

| Ustocktrade | Yes | No | No | |

| Virtu ITG POSIT | Yes | No | Yes | No |

| Virtu MatchIt | Yes | No | Yes | No |

| Liquidnet H2O ATS | Yes | No | Yes | No |

| Liquidnet Negotiation ATS | Yes | No | Yes | No |

| Fidelity CrossStream | Yes | No | Yes | No |

Item 6: Activities of Service Providers

6a) Does any employee of the Broker-Dealer Operator or its Affiliate that services both the operations of the NMS Stock ATS and any other business unit or any Affiliate of the Broker-Dealer Operator ("shared employee") have access to confidential trading information on the NMS Stock ATS?

6b) Does any entity, other than the Broker-Dealer Operator, support the services or functionalities of the NMS Stock ATS ("service provider") that are required to be explained in Part III of this form?

6c) If yes to Item 6b) , does the service provider, or any of its Affiliates, use the NMS Stock ATS services?

6d) If yes to Item 6c) , are the services that the NMS Stock ATS offers and provides to the entity required to be identified in Item 6c) the same for all Subscribers?

| ATS Name | 6a) | 6b) | 6c) | 6d) |

|---|---|---|---|---|

| BIDS | No | Yes | No | |

| LeveL | No | Yes | Yes | Yes |

| Luminex | No | Yes | Yes | Yes |

| DEALERWEB | Yes | No | ||

| CitiBLOC | Yes | Yes | No | |

| CSFB Crossfinder | Yes | Yes | No | |

| DB SuperX | Yes | Yes | No | |

| IntelligentCross | Yes | Yes | No | |

| Virtu ITG POSIT | Yes | Yes | No | |

| JPB-X | Yes | Yes | No | |

| Virtu MatchIt | Yes | Yes | No | |

| The Barclays ATS | Yes | Yes | No | |

| BofA Instinct X | Yes | Yes | No | |

| Piper XE | Yes | Yes | No | |

| PRO Securities | Yes | Yes | No | |

| GSCO Sigma X2 | Yes | Yes | No | |

| Ustocktrade | Yes | Yes | No | |

| Fidelity CrossStream | Yes | Yes | No | |

| Aqua | Yes | Yes | Yes | Yes |

| Instinet BlockCross | Yes | Yes | Yes | Yes |

| CODA | Yes | Yes | Yes | Yes |

| Instinet CBX | Yes | Yes | Yes | Yes |

| JPM-X | Yes | Yes | Yes | Yes |

| Liquidnet H2O ATS | Yes | Yes | Yes | Yes |

| Liquidnet Negotiation ATS | Yes | Yes | Yes | Yes |

| MS POOL | Yes | Yes | Yes | Yes |

| MS RPOOL | Yes | Yes | Yes | Yes |

| MS Trajectory Cross | Yes | Yes | Yes | Yes |

| Instinet Crossing | Yes | Yes | Yes | Yes |

| IBKR ATS | Yes | Yes | Yes | No |

| UBS ATS | Yes | Yes | Yes | No |

Item 7: Protection of Confidential Trading Information

7b) Can a Subscriber consent to the disclosure of its confidential trading information to any Person (not including those employees of the NMS Stock ATS who are operating the system or responsible for its compliance with applicable rules)?

7c) If yes to Item 7b) , can a Subscriber withdraw consent to the disclosure of its confidential trading information to any Person (not including those employees of the NMS Stock ATS who are operating the system or responsible for its compliance with applicable rules)?

| ATS Name | 7b) | 7c) |

|---|---|---|

| Aqua | No | |

| BIDS | No | |

| CitiBLOC | No | |

| DB SuperX | No | |

| DEALERWEB | No | |

| IBKR ATS | No | |

| IntelligentCross | No | |

| JPB-X | No | |

| JPM-X | No | |

| BofA Instinct X | No | |

| Piper XE | No | |

| PRO Securities | No | |

| GSCO SIGMA X2 | No | |

| Ustocktrade | No | |

| Fidelity CrossStream | No | |

| Instinet BlockCross | Yes | Yes |

| CODA | Yes | Yes |

| CSFB Crossfinder | Yes | Yes |

| LeveL | Yes | Yes |

| Instinet CBX | Yes | Yes |

| Virtu ITG POSIT | Yes | Yes |

| Virtu MatchIt | Yes | Yes |

| The Barclays ATS | Yes | Yes |

| Luminex | Yes | Yes |

| Liquidnet H2O ATS | Yes | Yes |

| Liquidnet Negotiation ATS | Yes | Yes |

| MS POOL | Yes | Yes |

| MS RPOOL | Yes | Yes |

| MS Trajectory Cross | Yes | Yes |

| UBS ATS | Yes | Yes |

| Instinet Crossing | Yes | Yes |