Tariffs and turmoil: A shift in European liquidity dynamics

The dust is only just beginning to settle after a turbulent week in the markets, revealing a dramatic shift in the European trading landscape. Many are bracing for further developments, as rising costs reshape liquidity and prompt a reassessment of risk and exposure across European large-cap stocks.

Let's dive in.

Summary

Elevated Trading Costs: Trading costs have remained high due to ongoing tariff uncertainty, with average spreads for large-cap stocks in the UK, France, and Germany peaking at 8.5 basis points, 167% above Q1 averages. By the end of the week, spreads narrowed to 124% above the average.

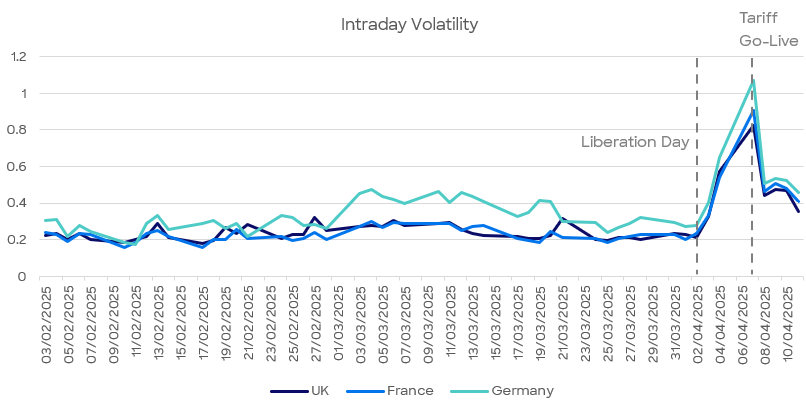

Increased Market Volatility: Intraday volatility surged significantly post-Liberation Day, reaching levels nearly 3.9 times higher than those observed on that day. The metric oscillated between 200% and 217% before easing to 174% by Friday.

Subdued Trading Activity: Investor reluctance is evident as touch sizes remain low, with top-of-book volumes declining by an average of 54%. France experienced the steepest drop, down 64% compared to previous averages.

Shift in Trading Dynamics: European daily trading volumes spiked to over €138 billion on tariff go-live day, significantly higher than previous sessions. This shift has seen a migration from closing auctions to lit continuous markets as traders seek immediate execution amidst uncertainty.

Figure 1: Volatility of UK, French and German large caps increased by ~48% the day after Liberation day, and continued to rise by another 60% the day after.

Trading costs remain elevated amidst ongoing tariff uncertainty

Uncertainty has persisted since Liberation Day and can be observed by the subsequent daily increases in intraday volatility. By Monday 7th April, volatility had surged to nearly 3.9 times the levels seen on Liberation Day across large-cap stocks in the UK, France, and Germany. For context, the last time volatility reached such heights was during the announcement of an effective COVID-19 vaccine.

Since the tariff implementation, a series of alternating reprieve and retaliatory announcements has driven sustained volatility, with the metric oscillating between 200% and 217% vs Liberation day, before easing to 174% by Friday.

Figure 1: Intraday volatility of UK, French & German Large Caps has increased by ~48%, 67% and 58% on subsequent days post-liberation day.

Source: BMLL and Liquidnet internal data

Touch sizes remain subdued relative to Q1 2025 averages, indicating a continued reluctance among investors to place larger orders at the best bid and offer in lit markets. On Monday, top-of-book volumes declined by an average of 54%, with France seeing the steepest drop among the top three equity markets, down 64%.

Figure 2: BBO touch sizes of UK, French & German Large Caps remain light during the tariff war.

Source: BMLL and Liquidnet internal data

Investor caution is evident in a reduced willingness to execute large trades at specific price levels, leading to a higher frequency of smaller transactions—a pattern commonly observed during periods of elevated uncertainty. This behaviour is further supported by the decline in average resting times to fill, as illustrated in Figure 3 below.

Figure 3: CBBO resting times to fill of UK, French and German Large Caps decline during the tariff war

Source: BMLL and Liquidnet internal data

The cost of trading remains higher relative to historical norms, though they have moderated since the implementation of the tariffs. Average spreads across UK, France, and Germany large caps have narrowed from Monday’s peak of 8.5 basis points, 167% above the Q1 average, to 124% by the end of the week.

Figure 4: Spreads remain elevated, reflecting a high cost to trade with urgency.

Source: BMLL and Liquidnet internal data

European volume distribution: A changing dynamic

European daily trading volumes surged to over €138 billion on tariff go-live day, surpassing €124 billion in the previous session. Monday's volumes were 214% higher than the average daily volume for 2024, and 163% above the levels seen on Liberation Day. While volumes tapered in the subsequent days, dropping to €66 billion on Friday, they remain elevated relative to historical averages.

Figure 5: European average daily notional traded. Addressable liquidity ex OTC/off-book on exch.

Source: BMLL and Liquidnet internal data

Over the last few years, typically a significant portion of addressable volumes in Europe has been traded during the closing auction, a trading event that has seen considerable growth over the past decade, averaging over 24% of market share in 2024. This shift has contributed to the reduction in volumes traded on lit continuous venues, as market participants aimed to minimise market impact and participate in a larger liquidity event.

However, starting in January and potentially due to the changes in geopolitical dynamics, a notable shift occurred in this trend, which was further accentuated by the unfolding tariff developments. Investors increasingly prioritised immediacy, turning to lit continuous venues for the greater certainty of execution these markets offer.

Figure 6 illustrates the sharp decline in closing auction volumes around Liberation Day and the tariff go-live. The data clearly shows a migration of volume, with traders pivoting to lit continuous markets to quickly execute trades in response to ongoing uncertainty.

Figure 6: European market share for closing auction and lit continuous venues. Addressable liquidity ex OTC/off-book on exch.

Source: BMLL and Liquidnet internal data

Given the current market conditions, it’s crucial to recognise the rise in transaction costs. To mitigate implicit costs, one can adjust algorithm parameters and optimise venue access by strategically combining dark block liquidity with lit continuous markets, which can offer more efficient execution.

Written by Prashanth Manoharan, Head of Execution Consulting, EMEA

The information provided by Liquidnet is for institutional investor use and is intended for the recipient only. Any disclosure, reproduction, distribution or other use of the message or any information generated by the product by an individual or entity other than the intended recipients prohibited. Please contact your Liquidnet coverage for more information about any of the information and analysis provided herein.